More than 75% pay too much tax on their rented property!

👍 Do you have any questions? We are happy to help you personally, easily and promptly by phone, WhatsApp and email!

Over 90% of all rented properties are depreciated over 50 years as standard.

With an appraisal to shorten the remaining useful life of your rented property, you can save money because - with this appraisal - the building portion of your rented property can be depreciated more quickly than with the usual 50 (or 40) years and you can thus easily and with little effort reduce your taxable income. reduce your taxable income with little effort(often by a significant amount) and thus significantly reduce your overall tax burden.

And the process for this assessment is very simple. In most cases, no on-site inspection is necessary if the necessary documents are available in a detailed and good quality.

Click here to go directly to our online calculator "

Remaining useful life reports - simply explained

The function of a remaining useful life expert opinion (or in correct technical terminology: "Expert opinion for the depreciation of buildings according to the shorter actual useful life (Section 7 (4) sentence 2 of the Income Tax Act") is to demonstrate by means of an expert opinion that the tax office should not and may not apply the otherwise standardized 50 years or 40 years for the depreciation of the building portion for your property.

By depreciating the taxable portion of the building more quickly, you benefit from considerable tax advantages due to the tax progression and the receipt of the tax-free sale after 10 years of private ownership.

If you have any further questions, please do not hesitate to contact us.

Expert opinion on purchase price allocation - simply explained

The purpose of an expert opinion on the apportionment of the purchase price is to provide the tax office with an expert opinion on the plausibility of the relationship between the land and the building (or part of the building) on it.

In every normal real estate transaction (purchase of a condominium, purchase of an apartment building, etc.), you buy the land and the building and/or a part of the building located on this land ("land and stones").

Since you are buying the ground on which the property is located cannot be claimed for tax purposes (= depreciate), as land (from the point of view of the tax office) does not depreciate and will continue to exist in this form for a long time to come, it is naturally in your interest to buy as little land as possible and increase the depreciable portion of the building.

We pursue precisely this goal with various approaches in order to optimize your building share vis-à-vis the tax office.

If you have any further questions, please do not hesitate to contact us.

Combination of remaining useful life appraisal and purchase price allocation

The combination of a remaining useful life appraisal and purchase price allocation enables you to achieve the optimum tax benefits for your property or properties within the scope of the tax depreciation options (AfA).

We would be happy to help you with a more detailed assessment of your individual circumstances.

If you have any further questions, please do not hesitate to contact us.

In the press

Our service promise

- Often save several thousand euros in taxes per year with an expert opinion on shortening the remaining useful life.

- Cancellation of the remaining useful life appraisal is possible free of charge if the calculated remaining useful life of our online calculator deviates from the report to your disadvantage. (Unfortunately, separate services such as the booked and carried out on-site inspection cannot be canceled).

- Works with existing and newly acquired properties, i.e. properties already assessed by the tax office also benefit from an appraisal.

- Retroactive dating is possible without any problems. Simply refer to the last outstanding tax assessment notice.

- Free support in communicating with the tax office after submitting the report.

- We will be happy to provide you with the optimized cover letter for submission to the tax office free of charge.

- No advance payment = no risk. Risk-free purchase on account. You only pay when you receive the report by e-mail.

- Personal contact persons by phone, e-mail or chat who will be happy to answer your questions.

- Fast processing within a few weeks. As a rule, you will receive your report in less than 3 weeks

- Do you need the report faster? Then book our express option and you will receive your report within 1 week.

Calculate the remaining useful life directly now "

Does that work at all?

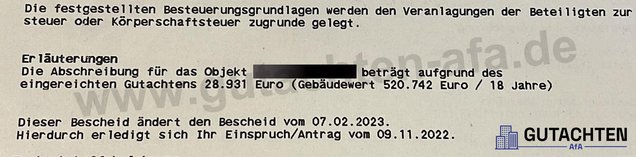

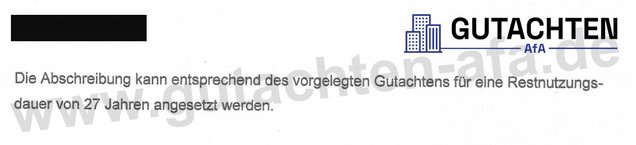

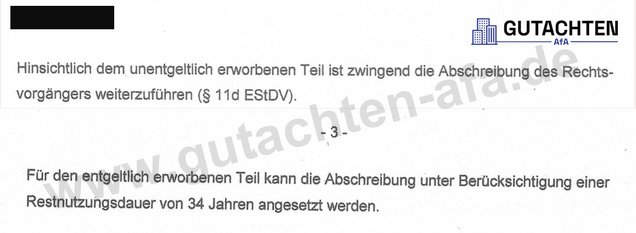

Yes, it works! Here you can see a selection of current expert opinions issued by tax offices throughout Germany.

Everything you need to know about real estate depreciation!

Summary

- Introduction to the topic of depreciation for real estate

- The calculation of depreciation

- Authorized persons for depreciation

- Start of depreciation

- Different types of depreciation

- Special regulations for listed buildings and refurbished buildings

- Residual value depreciation for buildings in the old and new federal states

- Important tips for your tax return

What documents are needed for the preparation of an expert opinion?

For the preparation of an expert opinion on the remaining useful life of your real estate you will need

- Information about the type of real estate

- Information about the condition of the property

- Construction method

- state of renovation of

- heating

- Roof

- Fixed

- Bathroom (if it is a condominium) or bathrooms (if it is your apartment building)

- General questions about the property

- Year of construction

- Living space and usable area

- Number of usage units

- Number of floors

- Change of floor plans

- further required documents

- object pictures (ideally inside and outside)

- (current) energy certificate

- site plan

- floor plans

All necessary information can also be found in detail in our checklist and/or order form.

Calculate tax benefit now

With our depreciation calculator and some key data of your rented property you can easily calculate your potential tax advantage!