Examples

Here you will find a selection of expert opinions that have already been prepared and the associated reduction in the remaining useful life (RND). All the examples shown have been successfully submitted to the relevant tax office and successfully accepted.

This list will be continuously expanded!

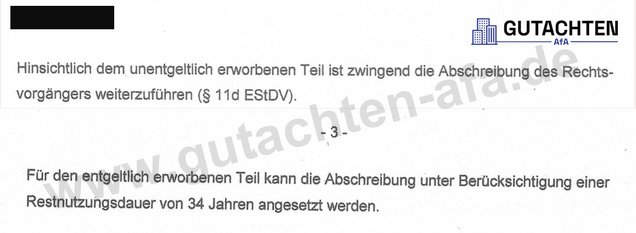

Condominium in Munich (MUC-00001)

Condominium in a WEG - Tax savings € 1,226.31 per year

Properties of the apartment

- Year of construction 1971

- 2 rooms

- 45.5 sqm

Key tax data

- Acquisition costs € 303,013.45 (incl. depreciable ancillary purchase costs (KNK) such as land transfer tax, estate agent's fee, notary and land register costs, etc.)

- Land portion € 119,066.61 (not depreciable)

- Building share € 183,946.84 (depreciable costs incl. KNK)

- Purchase 2021

- Standard depreciation of 50 years → therefore actually depreciation until 2071

- According to expert opinion, remaining useful life → 30 years (reduced depreciation until 2051)

- Depreciation

- before the expert opinion → € 3,678.94 (€ 183,946.84 / 50 years depreciation)

- after the appraisal → € 6,131.56 (€ 183,946.84 / 30 years depreciation)

- Tax savings: € 1,226.31 per year (at ~50% tax rate for simplified calculation)

- (New depreciation minus old depreciation) / 2 → (€ 6,131.56 minus € 3,678.94) / 2

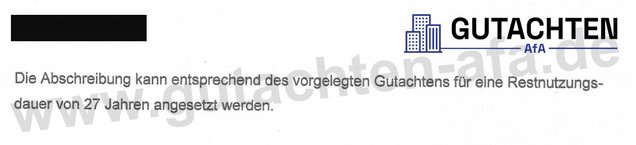

Condominium in Munich (MUC-00003)

Condominium in a WEG - Tax savings € 969.50 per year

Properties of the apartment

- Year of construction 1974

- 3.5 rooms

- 85 sqm

- 2 underground parking spaces

Key tax data

- Acquisition costs € 389,572.94 (incl. depreciable ancillary purchase costs (KNK) such as land transfer tax, estate agent's fee, notary and land registry costs, etc.)

- Land portion € 163,357.00 (not depreciable)

- Building portion € 226,215.94 (depreciable costs incl. KNK)

- Purchase in 2019

- Standard depreciation of 50 years → therefore actually depreciation until 2069

- According to expert opinion, remaining useful life → 35 years (reduced depreciation until 2054)

- Depreciation

- before the expert opinion → € 4,524.32 (€ 226,215.94 / 50 years depreciation)

- after the appraisal → € 6,463.31 (€ 226,215.94 / 35 years depreciation)

- Tax savings: € 969.50 per year (at ~50% tax rate for simplified calculation)

- (New depreciation minus old depreciation) / 2 → (€ 6,463.31 minus € 4,524.32) / 2

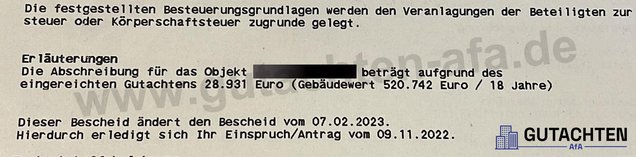

Condominium in Munich (MUC-00004)

Condominium in a WEG - Tax savings € 930.89 per year

Properties of the apartment

- Year of construction 1965

- 1 room

- 33.0 sqm

- 1 underground parking space

Key tax data

- Acquisition costs € 196,870.62 (incl. depreciable ancillary purchase costs (KNK) such as land transfer tax, brokerage fee, notary and land register costs, etc.)

- Land portion € 87,592.05 (not depreciable)

- Building share € 109,278.57 (depreciable costs incl. KNK)

- Purchase in 2019

- Standard depreciation of 50 years → therefore actually depreciation until 2069

- According to expert opinion, remaining useful life → 27 years (reduced depreciation until 2046)

- Depreciation

- before the expert opinion → € 2,185.57 (€ 109,278.57 / 50 years depreciation)

- after the appraisal → € 4,047.35 (€ 109,278.57 / 27 years depreciation)

- Tax savings: € 930.89 per year (at ~50% tax rate for simplified calculation)

- (New depreciation minus old depreciation) / 2 → (€ 4,047.35 minus € 2,185.57) / 2